Kroijer points out that most unit trust funds have under performed the market in the last decade. “Almost 90% of the equity mutual funds globally have underperformed the market in the past 10 years (net of fees), based on numerous studies and reports. While some fund managers were able to beat the market, they still underperformed after deducting the fees (which include the sales charge and annual management fee),” he says.

According to the S&P Dow Jones Indices’ semi-annual report published in September, the S&P Indices Versus Active (Spiva) scorecard shows that as at June, 87.5% of the actively managed equity funds in the US underperformed its benchmark in the past decade. The Spiva Europe Scoreboard, which measures the performance of actively managed European equity funds, says 96% of the European funds underperformed their benchmark over a 10-year period as at the end of last year. According to the scorecard, European actively managed emerging market equity funds also suffered the same fate.

“There is a widely held belief that active portfolio management can be most effective in less efficient markets, such as emerging market equities, as these markets can provide managers the opportunities to exploit perceived mispricing. However, this view is not substantiated by our research as active funds underperformed their benchmarks in all time horizons, with 96% of funds underperforming the 10-year period,” says the report.

The fees imposed on investors are the main reason these funds underperformed the market, says Kroijer. Throughout his career, he has seen many investors pay huge amounts of fees to fund managers only to see their funds underperform the markets.

He says this is especially true in the hedge fund industry. “It was very hard to distinguish between the hedge funds that created value and those that did not when the markets consistently went up during those years. It was only during the huge declines of 2008/09 that many hedge fund managers found out that they had only been taking a long position on the market without adding much value.

“Of course, some of them made a huge amount of money by providing a little more value-add [but that did not justify the fees]. No wonder there were a lot of angry investors.”

Kroijer says hedge funds usually charge investors a 2% annual management fee and 20% of the total net profit. While the charges of unit trust funds are much lower than hedge funds, it is still not good enough as 9 out of 10 funds underperform the market net of fees, he points out.

The global equities index fund will provide you with diversification, compared with a single country ETF. For instance, if you only buy into the Malaysian index and it goes down by 50%, you will take a hit in your portfolio. But the global equities index fund as a whole may be unaffected.

Currently, there aren’t any global equity ETFs on Bursa Malaysia. But local investors can access them via overseas brokerage accounts.

Investors could look at the db x-trackers MSCI World Index UCITS ETF, which is listed on the Singapore Exchange, or the Infinity Global Stock Index Fund, which feeds into the Vanguard Global Stock Index Fund. The latter tracks the MSCI World Free Index, which comprises a basket of 1,600 stocks.

Investors could also look into the Vanguard Total World Stock ETF and iShares MSCI World Equity ETF, which are listed on the New York Stock Exchange.

> Lars Kroijer, author of Money Mavericks: Confession of a Hedge Fund Manager and Investing Demystified: How to Invest without Speculation and Sleepless Nights.

|

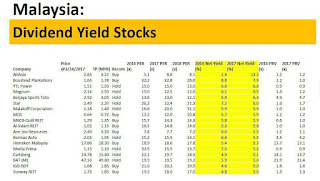

| See the dividends |

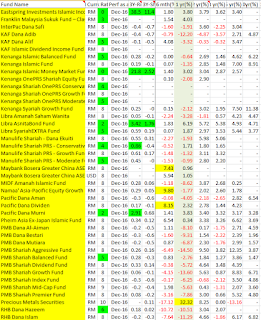

Thanks to Lars Kroijer for doing the research and confirming my hunch. Its simple, if the fund manager can't beat the average performance of EPF (EPF also weeding them out on yearly basis) or PNB, just liquidate and move on. Performance is everything because you are in the business of growing your own assets, not their assets. Look at the Dec16 performance table below and get the message. It really painful when the so called qualified professional lose your money on your behalf. Lose the money yourself, at least you gain the experience!

|

| 1,2,3,5,10 yrs anualised performance |

Hint: When the markets are badly down, look at their top holdings, if it is full of dividends paying company, hit the fund for a killing because market cannot be down all the time, it is a business as well here. Else who will pay for the managers salary!